Micron Technology, Inc. (NASDAQ:MU) recently released its first-quarter earnings report, highlighting a promising forecast driven by the growing demand for memory chips, particularly in artificial intelligence (AI) applications. This demand surge is reshaping the landscape for semiconductor companies, providing a robust outlook for the near future.

Micron’s earnings exceeded Wall Street expectations, showcasing a remarkable turnaround from previous quarters. The company’s strategic focus on expanding its DRAM and NAND memory production has paid off, aligning with the tech industry’s shift towards AI and machine learning technologies. These technologies require significant data processing capabilities, which in turn drive the need for advanced memory solutions.

Despite the global economic uncertainties, Micron remains optimistic about sustained growth. The increasing integration of AI in various sectors, from healthcare to automotive, underscores the critical need for efficient memory chips. As a result, Micron is investing heavily in R&D to develop next-generation memory technologies that can handle the rigorous demands of AI workloads.

Looking ahead, Micron’s leadership is confident that the demand for memory chips will continue to rise, fueled by AI and the broader digital transformation across industries. This optimism is reflected in their projected revenue growth and market position as a leader in memory solutions.

In addition to AI, other technological advancements such as 5G and the Internet of Things (IoT) are also contributing to the increased demand for memory products. These innovations require rapid data processing and storage capabilities, further bolstering the market for memory manufacturers like Micron.

Overall, Micron’s strong performance in the first quarter, coupled with strategic investments and a focus on cutting-edge technologies, positions the company to capitalize on the expanding memory market. As AI applications become more pervasive, the demand for high-performance memory solutions is expected to accelerate, promising a prosperous future for Micron and the semiconductor industry at large.

Footnotes:

- Micron’s earnings report reflects its strategic focus on AI-driven memory demand. Source.

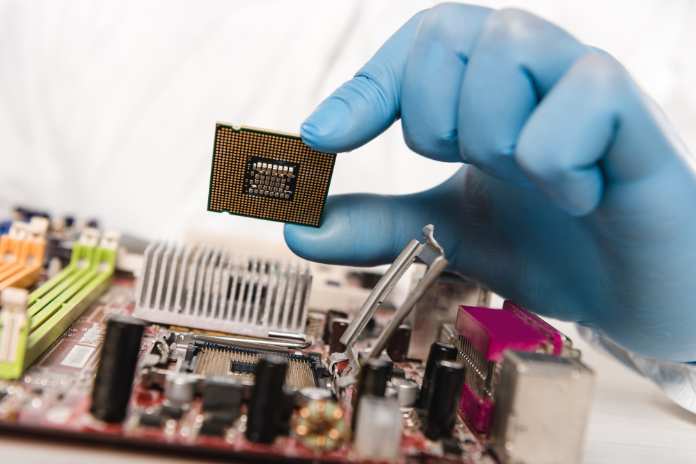

Featured Image: DepositPhotos @ AllaSerebrina